Comprehensive Guide To Wells Fargo Notary Service Fee: Everything You Need To Know

When it comes to banking services, Wells Fargo stands out as one of the most prominent institutions in the United States. Among its various offerings, the Wells Fargo notary service fee is a critical aspect that many customers seek clarification on. Whether you're finalizing a loan document, signing a legal contract, or handling estate planning, understanding the fees associated with notary services can save you time and money.

Notary services play an essential role in verifying the authenticity of important documents. With Wells Fargo's extensive network of branches and certified notaries, accessing these services has become more convenient than ever. In this article, we will delve into the details of Wells Fargo notary service fees, explore how they compare to other banks, and provide valuable tips to help you make an informed decision.

By the end of this guide, you'll have a clear understanding of what to expect when using Wells Fargo's notary services. Let's dive in and uncover the ins and outs of this essential banking feature.

Read also:Perfectgirls A Comprehensive Guide To Understanding And Navigating The Platform

Table of Contents

- Introduction to Notary Services

- Wells Fargo Notary Service Fee Overview

- Availability of Notary Services at Wells Fargo

- Comparison with Other Banks

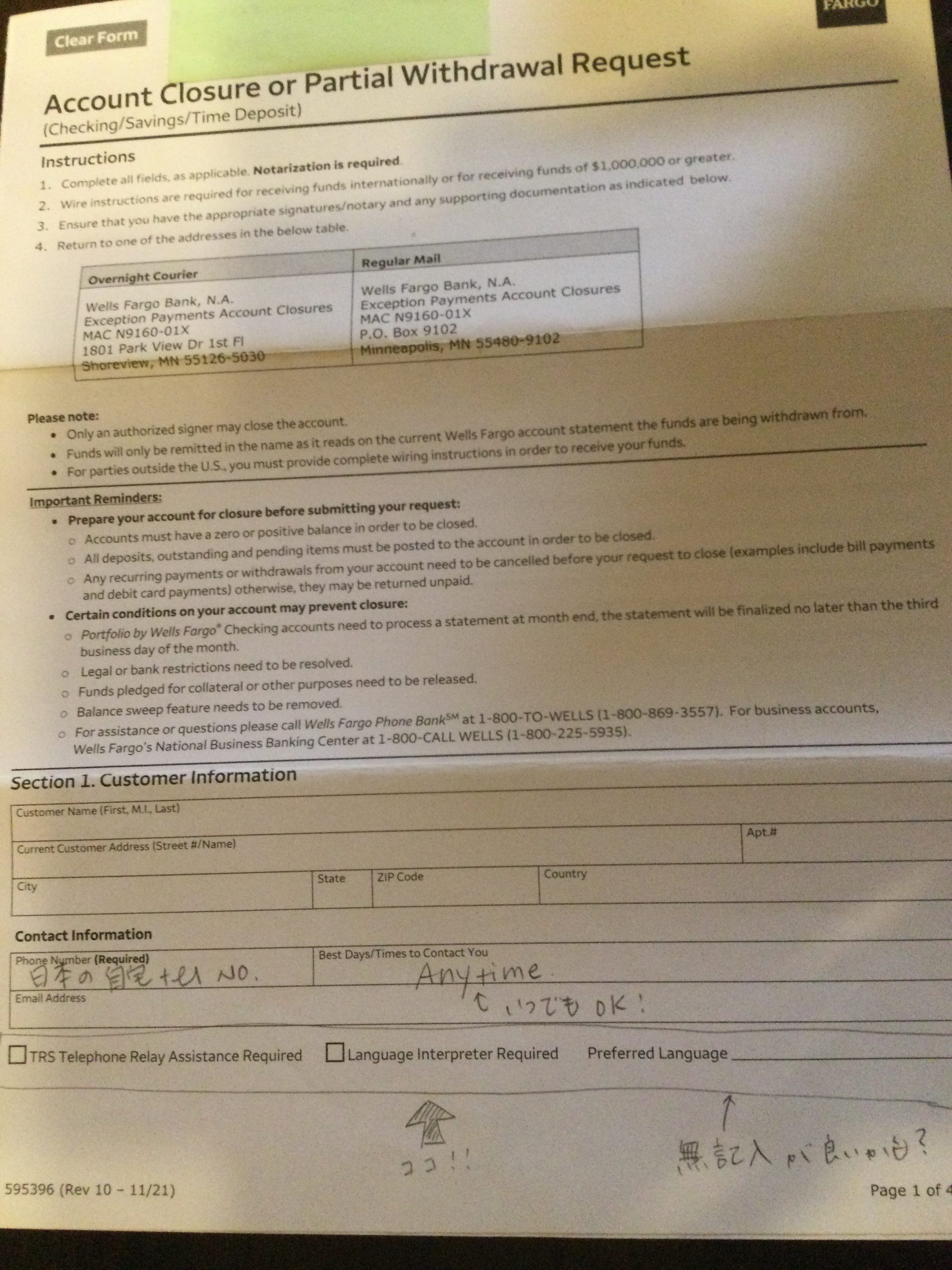

- Types of Documents Requiring Notarization

- Frequently Asked Questions

- Tips for Using Wells Fargo Notary Services

- Benefits of Using Wells Fargo Notary Services

- Legal Considerations

- Conclusion

Introduction to Notary Services

Notary services are essential for verifying the authenticity of signatures on legal documents. A notary public is a certified official who acts as a neutral witness to ensure that all parties involved in a transaction are willingly participating and that the document is genuine. This process helps prevent fraud and ensures that the document holds up in court if necessary.

While many people associate notary services with real estate transactions, they are also commonly used for powers of attorney, wills, affidavits, and other important documents. Understanding the role of a notary public and the associated costs is crucial, especially when dealing with sensitive legal matters.

Why Are Notary Services Important?

- They provide legal validation for important documents.

- They help prevent fraud by verifying identities.

- They ensure compliance with state and federal regulations.

Wells Fargo Notary Service Fee Overview

One of the most common questions customers have is, "How much does Wells Fargo charge for notary services?" The good news is that Wells Fargo offers free notary services to its account holders. This means that if you have an active account with the bank, you can access notary services at no additional cost. However, it's important to note that non-customers may be subject to a fee, which typically ranges from $10 to $20 depending on the location and specific services required.

While the exact fee structure can vary, Wells Fargo generally adheres to state regulations regarding notary fees. It's always a good idea to confirm the cost with your local branch before scheduling an appointment.

Factors Affecting Notary Fees

- Location of the branch

- Type of document being notarized

- Whether you're a Wells Fargo customer

Availability of Notary Services at Wells Fargo

Wells Fargo offers notary services at most of its branches across the United States. However, availability may vary depending on the location and the specific branch. To ensure that notary services are available at your nearest branch, it's advisable to call ahead and confirm. Many branches also require appointments, especially during busy periods, so planning in advance is key.

Additionally, some Wells Fargo branches may have mobile notary services available for customers who cannot visit the branch in person. This service is particularly useful for those who require notarization but have mobility issues or live in remote areas.

Read also:Kara Mckinney Biography The Journey Of A Rising Star

How to Find a Notary at Your Local Branch

- Use the Wells Fargo branch locator tool on their website.

- Call the branch directly to confirm availability.

- Schedule an appointment to avoid long wait times.

Comparison with Other Banks

While Wells Fargo offers competitive notary services, it's worth comparing their fees and offerings with other major banks. Some banks, like Bank of America and Chase, also provide free notary services to their account holders. However, non-customers may face higher fees at these institutions compared to Wells Fargo.

It's important to note that the availability and cost of notary services can vary significantly between banks. Factors such as account type, location, and specific document requirements can all influence the final cost. Always research and compare before choosing a provider.

Key Differences Between Banks

- Fee structures for non-customers

- Availability of mobile notary services

- Additional perks for account holders

Types of Documents Requiring Notarization

Not all documents require notarization, but for those that do, it's essential to understand the process. Common documents that often need notarization include:

- Real estate deeds and mortgages

- Powers of attorney

- Wills and estate planning documents

- Affidavits and sworn statements

- Loan agreements

Each of these documents carries significant legal weight, making notarization a critical step in ensuring their validity. By using Wells Fargo's notary services, you can rest assured that your documents are properly authenticated and legally binding.

Frequently Asked Questions

Do I Need an Appointment for Notary Services at Wells Fargo?

While walk-ins are sometimes possible, it's highly recommended to schedule an appointment to avoid long wait times. This is especially true during peak hours or at busy branches.

Can Non-Customers Use Wells Fargo Notary Services?

Yes, non-customers can use Wells Fargo notary services, but they may be subject to a fee. The exact cost will depend on the location and specific services required.

What Documents Should I Bring for Notarization?

When visiting a Wells Fargo branch for notary services, be sure to bring the following:

- The document(s) requiring notarization

- Valid government-issued identification

- Any additional supporting documents, if applicable

Tips for Using Wells Fargo Notary Services

To make the most of your experience with Wells Fargo notary services, consider the following tips:

- Plan ahead and schedule an appointment to avoid delays.

- Double-check that all documents are complete and ready for notarization.

- Bring valid identification to verify your identity.

- Understand the specific requirements for the document you're notarizing.

By following these guidelines, you can ensure a smooth and efficient notarization process.

Benefits of Using Wells Fargo Notary Services

There are several advantages to using Wells Fargo's notary services:

- Convenience: With branches located throughout the U.S., accessing notary services is easy.

- Cost-Effectiveness: Free notary services for account holders save you money.

- Expertise: Wells Fargo employs certified notaries who are trained to handle a wide range of legal documents.

These benefits make Wells Fargo a reliable choice for your notary needs.

Legal Considerations

When using notary services, it's important to be aware of the legal requirements and regulations governing the process. Each state has its own rules regarding notarization, so it's crucial to understand the specific laws in your area. Wells Fargo's notaries are trained to comply with all applicable regulations, ensuring that your documents are properly authenticated and legally valid.

Additionally, be sure to review any documents thoroughly before signing them. A notary can verify your identity and ensure the document is signed correctly, but they cannot provide legal advice. If you have questions about the content of a document, consult with an attorney before proceeding.

Conclusion

In conclusion, Wells Fargo notary services offer a convenient and cost-effective solution for verifying important legal documents. Whether you're a long-time customer or a new account holder, accessing these services can save you time and money. By understanding the fees, availability, and legal considerations associated with notary services, you can make an informed decision about how best to proceed.

We encourage you to share this article with others who may benefit from the information and leave a comment below if you have any questions or feedback. Additionally, explore other resources on our website for more insights into banking and financial services.