Lithium Producers Stock: A Comprehensive Guide To Investing In The Future Of Energy

As the global demand for renewable energy sources continues to soar, lithium producers stock has become an increasingly attractive investment opportunity. Lithium, often referred to as the "white gold" of the energy transition, is a critical component in the production of electric vehicle (EV) batteries and energy storage systems. Investors looking to capitalize on this trend must understand the nuances of the lithium market and the companies driving its growth.

Lithium producers stock offers a unique opportunity to tap into the burgeoning green energy sector. With governments around the world setting ambitious targets for reducing carbon emissions, the demand for lithium-based technologies is expected to skyrocket. This article will delve into the key players in the lithium production industry, market trends, and strategies for making informed investment decisions.

Whether you're a seasoned investor or just starting out, understanding the dynamics of lithium producers stock is essential. In this guide, we'll explore everything you need to know about the lithium market, including the top companies, risks, and rewards. Let's dive in and uncover the potential of this exciting investment opportunity.

Read also:Discovering Wissam Al Manas New Journey A Closer Look At His New Wife

Table of Contents

- What Are Lithium Producers Stock?

- The Role of Lithium in the Global Energy Transition

- Top Lithium Producers Around the World

- Key Factors Influencing Lithium Producers Stock Performance

- Risks and Challenges in the Lithium Market

- How to Invest in Lithium Producers Stock

- Best Practices for Evaluating Lithium Companies

- Future Outlook for Lithium Producers Stock

- Sustainable Practices in Lithium Production

- Conclusion and Next Steps

What Are Lithium Producers Stock?

Lithium producers stock refers to shares issued by companies involved in the extraction, processing, and distribution of lithium. These companies play a pivotal role in the global energy transition by supplying the critical raw material needed for EV batteries, renewable energy storage solutions, and other advanced technologies. As demand for lithium continues to grow, so does the interest in these stocks among investors seeking to capitalize on the green energy revolution.

Why Lithium Producers Are Crucial

The importance of lithium producers cannot be overstated. With the global push toward decarbonization, industries are rapidly adopting lithium-ion batteries as a cleaner alternative to fossil fuels. This shift has created a surge in demand for lithium, making it one of the most sought-after commodities in the modern economy. Companies specializing in lithium production are at the forefront of this transformation, offering investors a chance to participate in a high-growth sector.

The Role of Lithium in the Global Energy Transition

Lithium is a cornerstone of the global energy transition due to its unique properties. Its lightweight nature and high energy density make it ideal for use in rechargeable batteries. As more countries commit to reducing their carbon footprints, the adoption of EVs and renewable energy systems is accelerating, driving up the demand for lithium-based technologies.

Key Applications of Lithium

- Electric Vehicles (EVs): Lithium-ion batteries power the majority of EVs on the market today.

- Renewable Energy Storage: Lithium batteries are used to store energy generated by solar panels and wind turbines.

- Consumer Electronics: From smartphones to laptops, lithium-ion batteries are ubiquitous in modern gadgets.

Top Lithium Producers Around the World

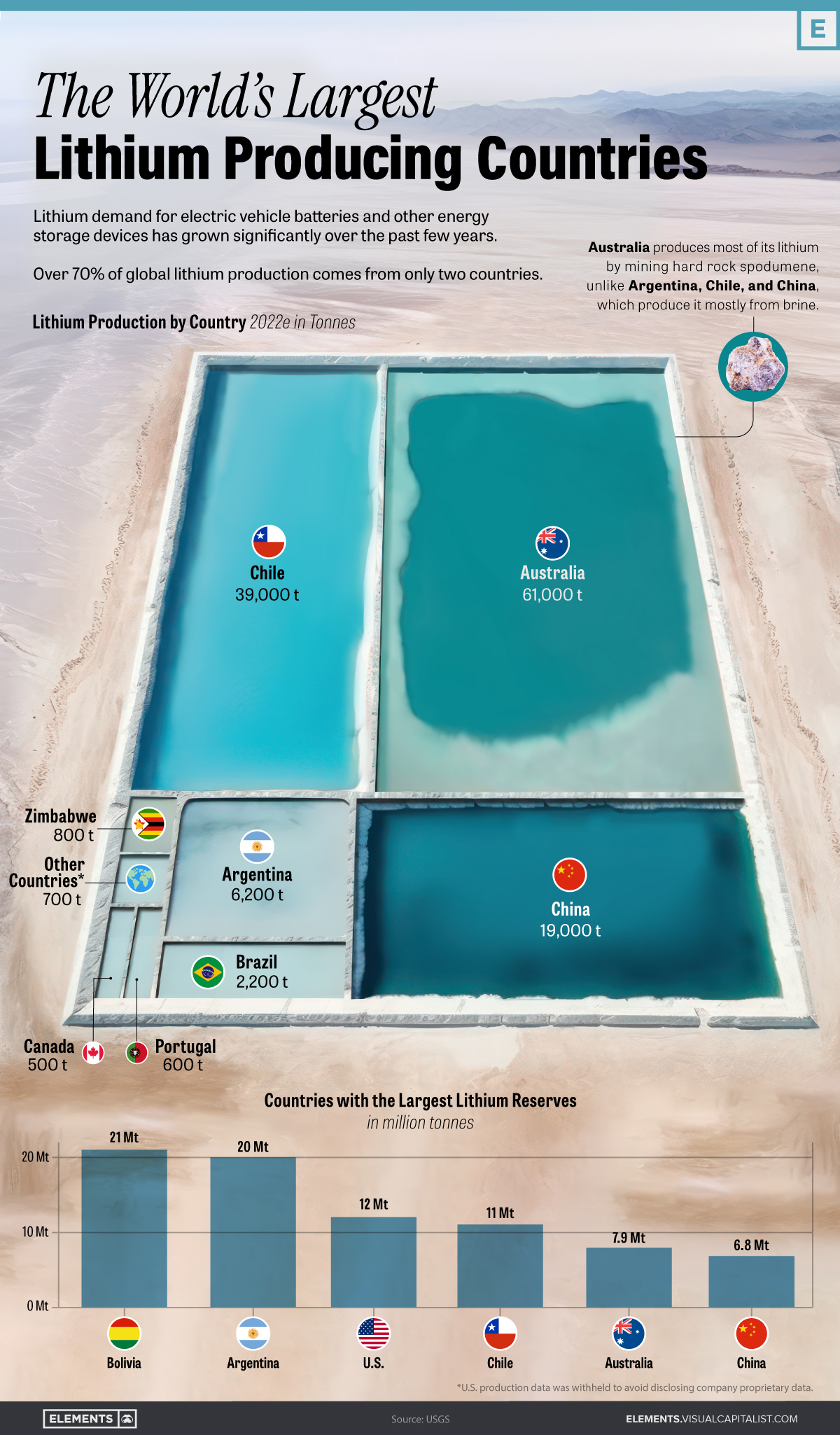

The lithium production industry is dominated by a handful of major players, each with its own strengths and strategies. Below, we explore some of the top lithium producers globally:

Leading Companies in the Lithium Market

- Albemarle Corporation: A U.S.-based company with significant operations in Chile and Australia.

- Sociedad Química y Minera de Chile (SQM): One of the largest lithium producers, with extensive resources in Chile's Atacama Salt Flat.

- Ganfeng Lithium: A Chinese company that has rapidly expanded its global footprint through strategic acquisitions.

- Livent Corporation: Known for its innovative approach to lithium production, Livent focuses on sustainability and efficiency.

Key Factors Influencing Lithium Producers Stock Performance

Several factors can impact the performance of lithium producers stock. Understanding these dynamics is crucial for making informed investment decisions:

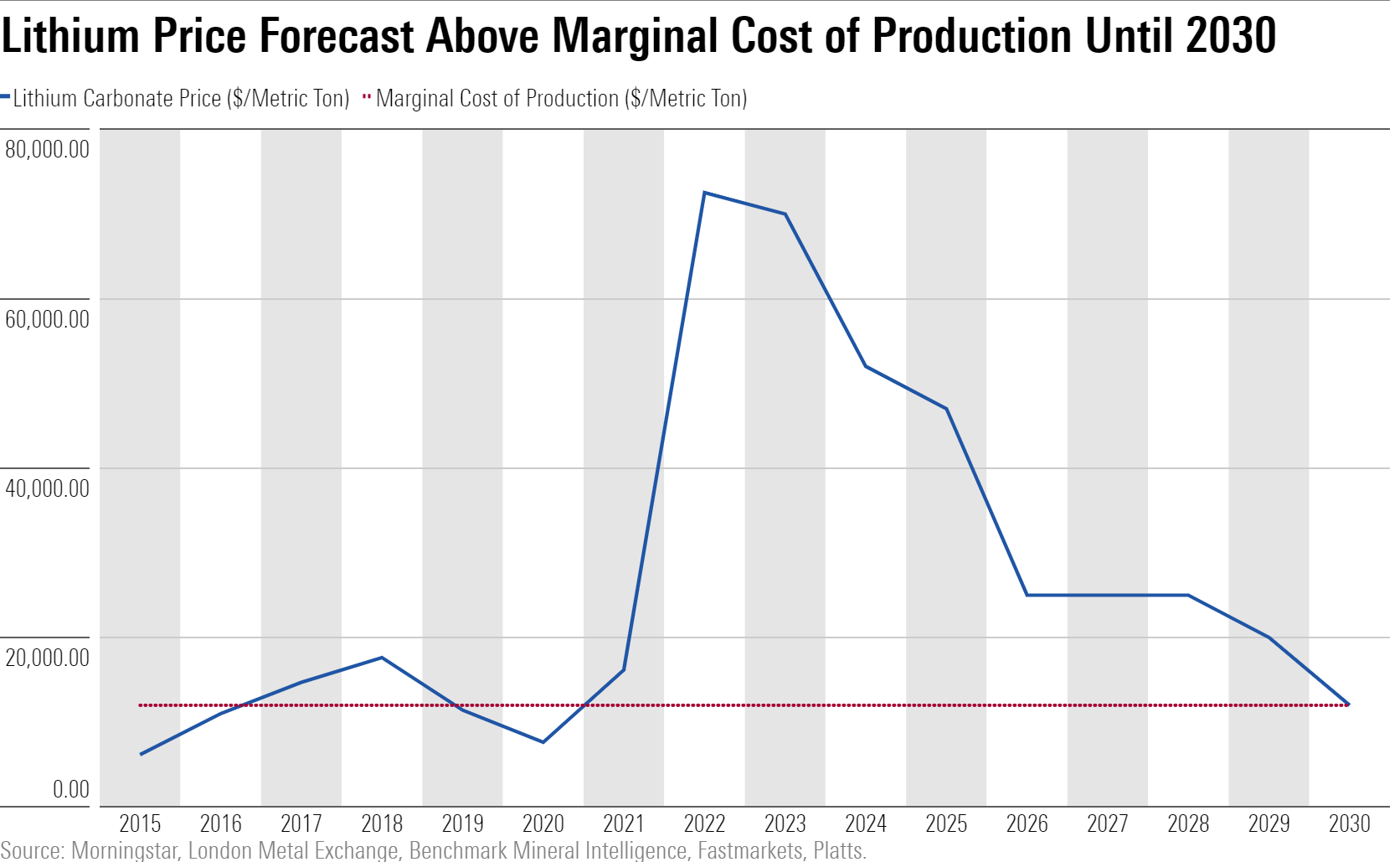

Supply and Demand Dynamics

The balance between supply and demand is a key driver of lithium prices. As demand for lithium continues to grow, producers must increase their output to meet market needs. However, supply constraints, such as limited access to high-quality lithium deposits, can lead to price volatility.

Read also:Natalie Hershlag The Talented Actress And Humanitarian Behind The Name

Technological Advancements

Innovations in lithium extraction and processing technologies can significantly affect the profitability of lithium producers. Companies that invest in research and development are better positioned to capitalize on emerging opportunities.

Risks and Challenges in the Lithium Market

While the lithium market presents numerous opportunities, it also comes with its fair share of risks:

Environmental Concerns

Lithium extraction can have significant environmental impacts, including water consumption and habitat disruption. Companies must adopt sustainable practices to mitigate these effects and maintain their social license to operate.

Geopolitical Risks

The concentration of lithium resources in certain regions, such as South America's "Lithium Triangle," exposes producers to geopolitical risks. Political instability or regulatory changes in these areas can affect supply chains and production costs.

How to Invest in Lithium Producers Stock

Investing in lithium producers stock requires careful consideration of various factors. Here are some steps to help you get started:

Research and Due Diligence

Before investing, thoroughly research the companies you're considering. Look into their financial performance, management team, and sustainability practices. Additionally, stay updated on industry trends and market conditions.

Diversification

To mitigate risk, consider diversifying your portfolio by investing in multiple lithium producers. This approach can help protect your investments from the impact of any single company's underperformance.

Best Practices for Evaluating Lithium Companies

When evaluating lithium companies, consider the following criteria:

- Resource Reserves: Assess the size and quality of the company's lithium reserves.

- Production Capacity: Look at the company's current and projected production levels.

- Sustainability Initiatives: Evaluate the company's commitment to environmentally friendly practices.

Future Outlook for Lithium Producers Stock

The future of lithium producers stock looks promising, driven by the ongoing energy transition and increasing demand for lithium-based technologies. However, companies must navigate challenges such as supply constraints and environmental concerns to succeed in this competitive market.

Growth Opportunities

As the global push for decarbonization intensifies, the demand for lithium is expected to grow exponentially. This presents significant growth opportunities for companies that can scale their operations and innovate in response to market needs.

Sustainable Practices in Lithium Production

Sustainability is becoming increasingly important in the lithium production industry. Consumers and investors alike are demanding more environmentally responsible practices from companies. Producers that prioritize sustainability are likely to gain a competitive edge in the market.

Water Management

One of the most significant environmental challenges in lithium production is water usage. Companies are exploring new methods to reduce water consumption and minimize the impact on local ecosystems.

Conclusion and Next Steps

In conclusion, lithium producers stock offers a compelling investment opportunity in the rapidly evolving energy landscape. By understanding the key players, market dynamics, and risks involved, investors can make informed decisions about participating in this high-growth sector.

We invite you to share your thoughts and experiences in the comments section below. Additionally, consider exploring other articles on our site to deepen your knowledge of the energy transition and sustainable investing. Together, we can build a greener future for all.

References:

- International Energy Agency (IEA): https://www.iea.org

- U.S. Geological Survey (USGS): https://www.usgs.gov

- BloombergNEF: https://about.bnef.com